Quicklinks

Filinvest Land, Inc. Raises PHP 10 Billion 4-Year and 6-Year Bonds on PDEx

Posted on: December 21, 2021

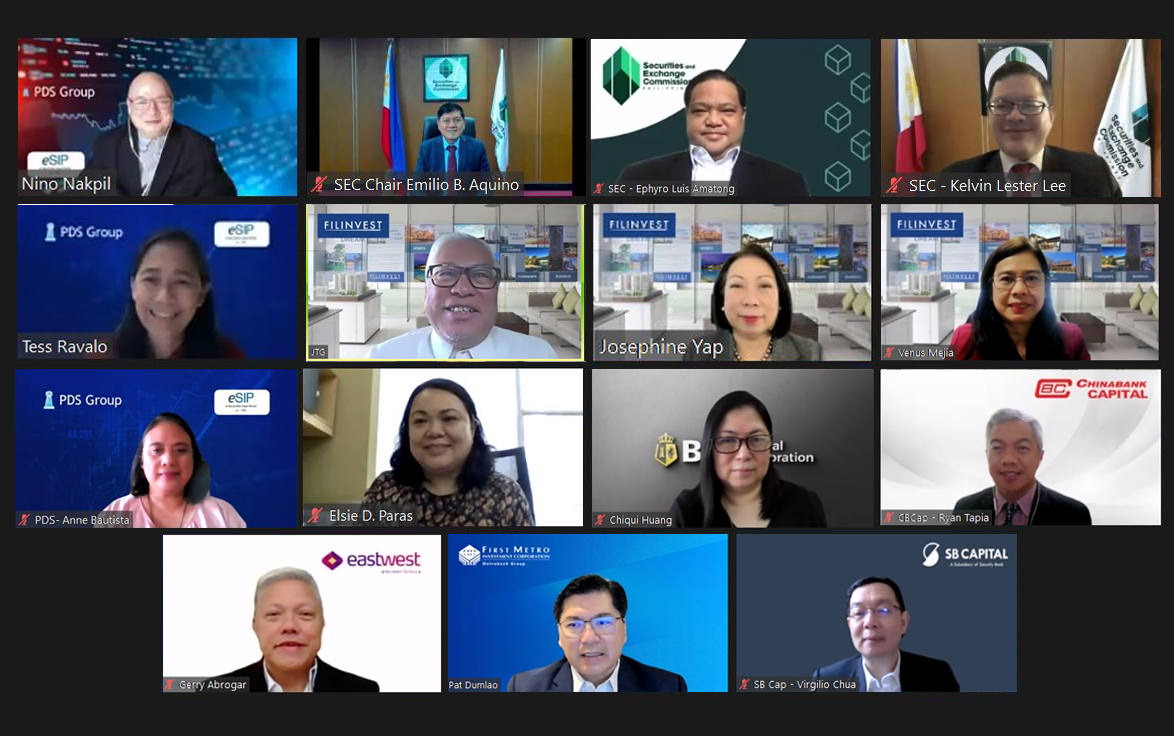

21 December 2021, Makati, Philippines — Filinvest Land, Inc. (FLI), a leading real estate developer in the Philippines returns to the Philippine Dealing and Exchange Corp (PDEx) today for the listing of its PHP 10 Billion 4-year and 6-year Fixed Rate Bonds. This issuance and listing is the second tranche of their 30 billion bond program which they registered in 2020.

PDEx President and CEO Antonino A. Nakpil in his welcome remarks congratulated FLI for good investor demand. He said: “Today’s listing keeps intact the trend of oversubscribed issuances by our community of Issuers, evidencing continued demand by public investors ready to support the funding requirements of firms as the economy progresses toward re-opening.”

The Securities and Exchange Commission Chairman Emilio B. Aquino was also in attendance and delivered a special message. “The SEC is glad to see FLI returning to the bond market for another listing. We are also happy to see that the company’s consistent record over its long history as well as its credit standing with the banking community and the bond markets have resulted in increased investor confidence and the expansion of the Philippine housing and land development market.”, remarked Hon. Aquino.

Meanwhile, FLI President and CEO Josephine Gotianun-Yap was grateful towards their beloved investors. She expressed: “We are thankful for the continued trust of our investors that drove the demand for the FLI bonds which resulted to an oversubscription of over four times of the base amount of PHP 8 Billion, a remarkable feat during this challenging time.”

This 21st listing for 2021 brings the year-to-date total of new listings to PHP 208.59 Billion, pushing the total level of tradable corporate debt instruments to PHP 1.29 Trillion issued by 53 companies, comprised of 189 securities.